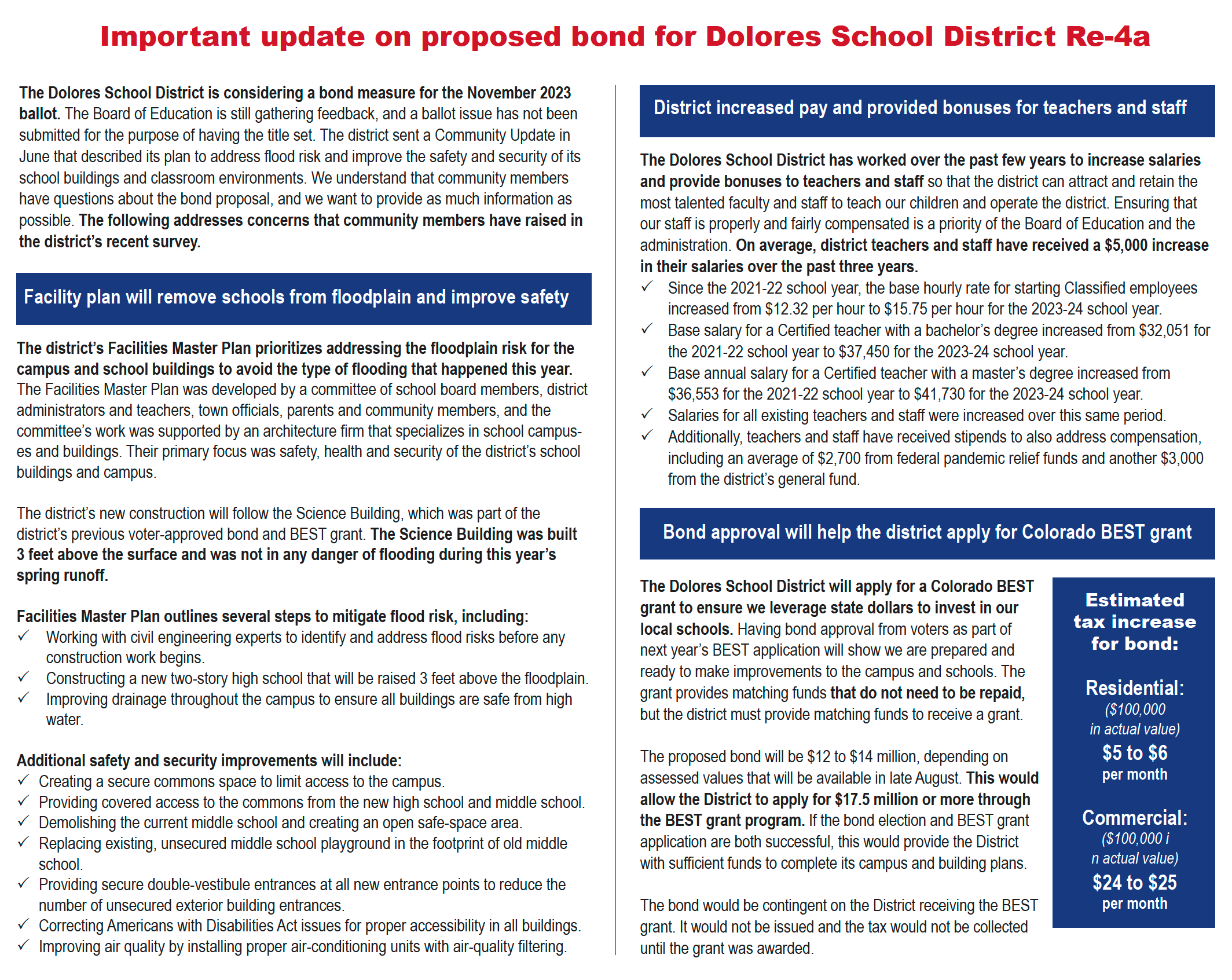

BALLOT ISSUE NO. 4:

SHALL DOLORES SCHOOL DISTRICT RE-4A DEBT BE INCREASED BY $11,210,000, WITH A REPAYMENT COST OF UP TO $22,000,000 MILLION, AND SHALL DISTRICT TAXES BE INCREASED BY UP TO $990,000 ANNUALLY BY THE ISSUANCE AND PAYMENT OF GENERAL OBLIGATION BONDS TO PROVIDE LOCAL MATCHING MONEY REQUIRED FOR THE DISTRICT TO RECEIVE STATE GRANT FUNDS (WHICH ARE NOT REQUIRED TO BE REPAID AND THE RECEIPT OF WHICH IS CONTINGENT UPON THE DISTRICT’S ABILITY TO PROVIDE THE MATCHING AMOUNT) UNDER THE BUILDING EXCELLENT SCHOOLS TODAY (“BEST”) PROGRAM TO FINANCE THE COSTS OF CAPITAL PROJECTS AND IMPROVEMENTS FOR DISTRICT PURPOSES, INCLUDING BUT NOT LIMITED TO:

• BUILDING AND EQUIPPING A NEW HIGH SCHOOL TO PROVIDE A STATE-OF THE-ART AND SAFE LEARNING ENVIRONMENTS, INCLUDING AN AGRICULTURE SCIENCE LAB, SECURE COMMON AREA, COVERED ACCESS AND DOUBLE-VESTIBULE ENTRANCES;

• RENOVATING EXISTING HIGH SCHOOL INTO THE MIDDLE SCHOOL TO PROVIDE MODERN, SECURE CLASSROOMS AND A DEDICATED BUS LOOP AND COVERED WALKWAYS;

• PERFORMING FLOOD MITIGATION AT DISTRICT FACILITIES BY IMPROVING DRAINAGE FLOW FROM RUNOFF AND REMOVING ALL NEW BUILDINGS FROM THE FLOOD PLAIN;

• RENOVATING THE ELEMENTARY SCHOOL TO PROVIDE A COVERED ENTRANCE FOR BUS AND PARENT DROP OFF LOCATIONS;

• IMPROVING BUILDINGS TO ENSURE COMPLIANCE WITH THE AMERICANS WITH DISABILITIES ACT;

• ADDRESSING CRITICAL SCHOOL REPAIRS INCLUDING HVAC TO IMPROVE INDOOR AIR QUALITY; AND

• DEMOLISHING EXISTING MIDDLE SCHOOL TO CONSTRUCT A SECURE PLAYGROUND AND COMMON AREA SPACE FOR STUDENTS;

WITH SUCH GENERAL OBLIGATION BONDS TO BEAR INTEREST, MATURE, BE SUBJECT TO REDEMPTION, WITH OR WITHOUT PREMIUM OF NOT MORE THAN THREE PERCENT, AND BE ISSUED AT SUCH TIME, AT SUCH PRICE (AT, ABOVE OR BELOW PAR) AND IN SUCH MANNER AND CONTAINING SUCH TERMS, NOT INCONSISTENT WITH THIS BALLOT ISSUE, AS THE BOARD OF EDUCATION MAY DETERMINE, AND SHALL AD VALOREM PROPERTY TAXES BE LEVIED WITHOUT LIMIT AS TO THE MILL RATE TO GENERATE AN AMOUNT SUFFICIENT IN EACH YEAR TO PAY THE PRINCIPAL OF, PREMIUM IF ANY, AND INTEREST ON SUCH DEBT AND ANY DEBT ISSUED TO REFUND SUCH DEBT, OR TO CREATE A RESERVE FOR THE SAME, PROVIDED THAT ANY REVENUE PRODUCED BY SUCH MILL LEVY SHALL NOT EXCEED $990,000 ANNUALLY; AND SHALL SUCH TAX REVENUES AND THE EARNINGS FROM THE INVESTMENT OF SUCH BOND PROCEEDS AND TAX REVENUES BE COLLECTED, RETAINED AND SPENT AS A VOTER APPROVED REVENUE CHANGE UNDER ARTICLE X, SECTION 20 OF THE COLORADO CONSTITUTION OR ANY OTHER LAW?